INVESTMENT STRATEGY

MULTI-FAMILY PROPERTIES:

1. ACQUIRE ONE-TO-FOUR-FAMILY RESIDENCES IN SELECT NEIGHBORHOODS THROUGHOUT THE NEW YORK METROPOLITAN AREA AT ATTRACTIVE VALUATIONS

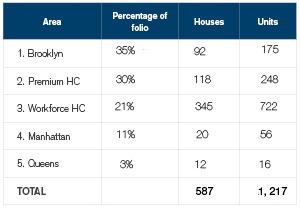

US Masters’ initial investment focus is the New York metropolitan area, the largest metropolitan area in the US by population and economic output. US Masters targets properties with the potential to achieve superior risk-adjusted income and long-term capital appreciation. To date, the Fund has invested over US$120 million in New York City, with a high concentration of acquisitions in Brownstone Brooklyn and parts of Manhattan including Harlem and the Upper West Side.

The Fund has invested over US$200 million in the Hudson County area of New Jersey, with a high concentration of acquisitions in up-and-coming Downtown Jersey City.

2. RESTORE THE PROPERTIES – DIXON PROJECTS

Dixon Advisory USA has developed a talented construction and architectural design team, Dixon Projects, to take advantage of the inherent market mispricing of properties that require rehabilitation. These properties can typically be acquired for a substantial discount even after accounting for construction and rehabilitation costs, allowing the Fund to buy cheaply, add value and achieve scale benefits. The scope of restoration ranges from cosmetic repair work through to full renovations on multi-million dollar historic residences. See more of our projects

3. PROVIDE TENANTS WITH NEWLY RENOVATED RESIDENCES IN GREAT NEIGHBORHOODS, IN CLOSE PROXIMITY TO MANHATTAN, WITH EXCEPTIONAL PROPERTY MANAGEMENT SERVICES – DIXON LEASING

The leasing and property management arm of Dixon Advisory USA, Dixon Leasing, provides our tenants with exceptional customer service and quick response times on all issues and requests. Our occupancy rate on rent-ready units is approximately 98% and our dedicated Dixon Leasing Team collectively manages in excess of 1,000 units.

View our available properties